- 949-667-2812

- Email Us

- Property Management

Menu

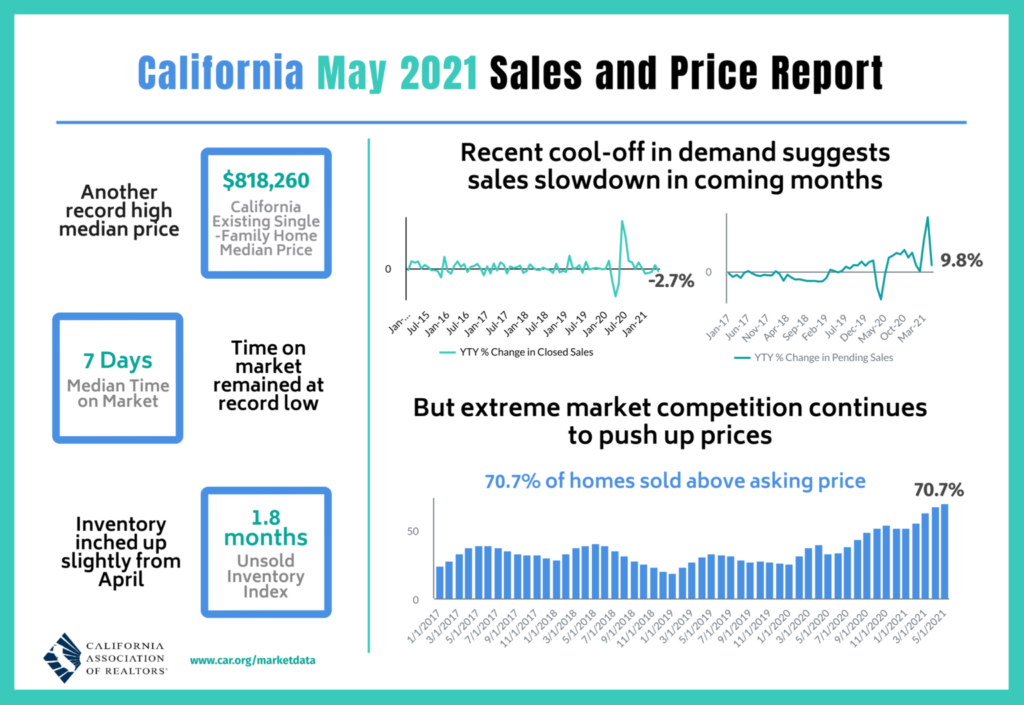

The California housing market ended the previous year on a high note as sales remained strong in December and the median house price reached another record high. The same momentum has been carried forward in 2021. Homes in California are staying on the market for about seven days (median time) before going under contract, with 70% of homes selling above their list prices, according to the data released by C.A.R. for May 2021.

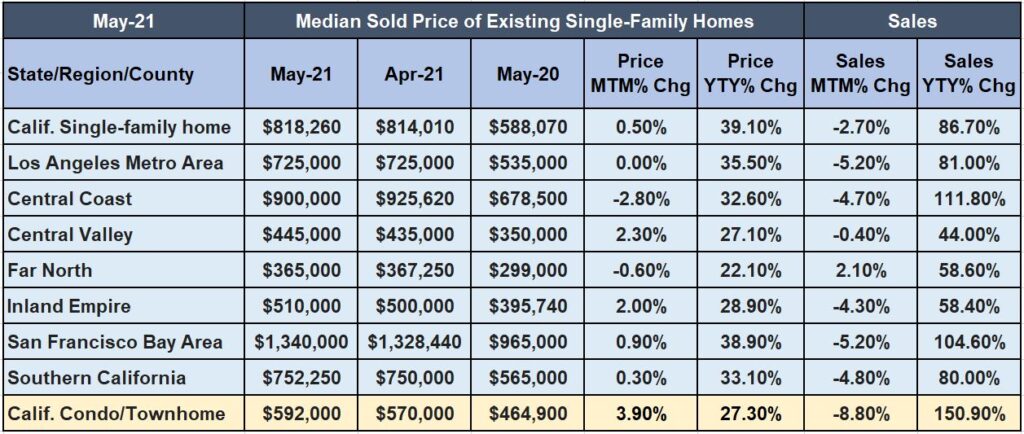

California’s median home price sets another new record high as the statewide median price inched up 0.5 percent on a month-to-month basis to $818,260 in May. The new median sales price of existing single-family homes is 39.1 percent higher than the $588,070 recorded last May when the real estate market in California tanked during the spring lockdown.

The year-over-year price increase was the largest ever, and it was the second month in a row that the state had an annual increase of more than 30%. It was the second time since June 2013 that the state recorded an annual increase of over 30 percent, according to the California Association of Realtors (C.A.R.). Just like the national housing market trends, the tight inventory and low mortgage rates are fueling the rise in California home prices. While this kind of price appreciation impacts housing affordability, higher home prices will hopefully encourage more sellers to list their homes for sale, which would in turn reduce the rate of appreciation.

On a monthly basis, closed escrow sales of existing single-family detached homes were down 2.7 percent from 458,170 in April but were up 86.7 percent from a year ago, when 238,740 homes were sold on an annualized basis. The sharp increase in annual sales was predicted, given how hard the housing market was impacted by the federal shutdown last year when home sales fell to their lowest point since the Great Recession.

“The overheated housing market is showing signs of a much-needed cooling and could be a sign of waning buyer interest as the torrid pace of home price increases and buyer fatigue adversely affected demand,” said C.A.R. President Dave Walsh. “We’re seeing many would-be buyers taking a break and hoping to see more listings as the economy reopens and prospective sellers list their homes for sale.”

Housing price gains were widespread with all the 51 counties in the state seeing annual price gains and 50 of them reporting at least a double-digit growth rate from last May. Thirty-two counties set new record high median prices in May. Mono had the largest price growth of 119.2 percent in May, followed by Santa Barbara (103.8 percent) and Plumas (57.2 percent).

In May 2021, three of the five major regions set new highs for median prices, with each region increasing by more than 20% year over year. The San Francisco Bay Area had the highest year-over-year gain of 38.9 percent, followed by Southern California (33.1 percent), the Central Coast (32.6 percent), the Central Valley (27.1 percent), and the Far North (22.1 percent).

California is a seller’s market and home prices have reached new record-highs across all the regions due to tight supply. Homes are moving nearly 46% faster than a year ago; the median time on the market was 7 days in May. Nearly 70% of homes sold above the asking price in May. New construction can’t keep up with demand in the California housing market. Every major region saw home prices continuing to increase from last year by double digits as buyers competed amid a shortage of homes for sale.

There is an increase in demand leading to bidding wars and subsequent higher selling prices. These trends show us that the California housing market remains very competitive. Growth of sales are prices are driven by low mortgagee rates, buyers seeking more living space, and a perennial shortage of houisng supply. Homes are selling quickly with a minimal price reduction. The statewide sales-price-to-list-price ratio was 103.8 percent in May (a record high). If it’s above 100%, the home sold for more than the list price. If it’s less than 100%, the home sold for less than the list price.

High demand across all of California’s sub-markets means that low inventory and lightning-fast market conditions are not going away soon. There just aren’t enough homes listed for sale to satisfy the demand from buyers. C.A.R.’s Unsold Inventory Index (UII) remains low at 1.8 months in May, slightly up from April but remained sharply below last year’s level. The index indicates the number of months it would take to sell the supply of homes on the market at the current rate of sales.

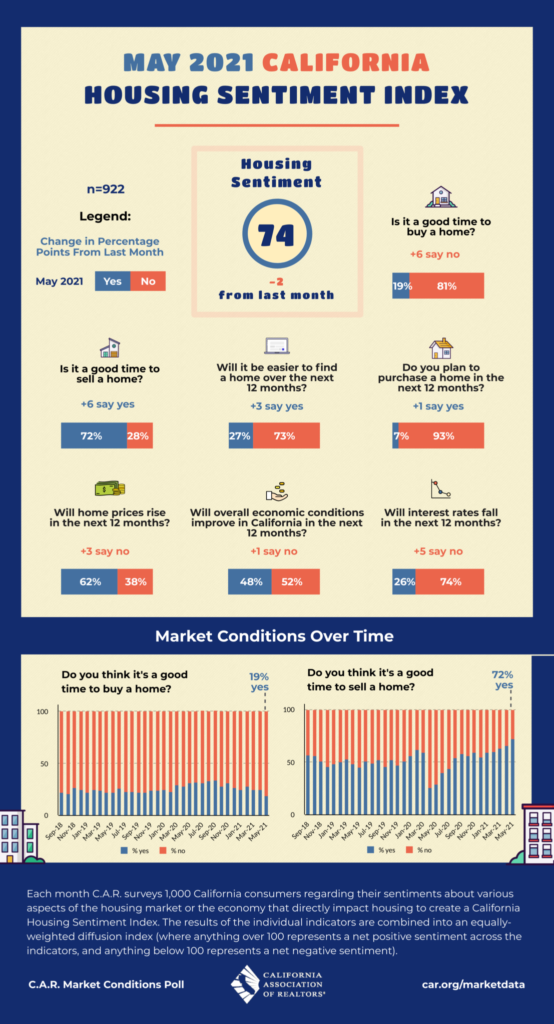

Each month C.A.R. surveys 1,000 California consumers regarding their sentiments about various aspects of the housing market or the economy that directly impact housing to create a California Housing Sentiment Index. In May 2021, the overall housing sentiment index reached 74 (-2 from last month). With mortgage rates near historic lows and buyers’ interest remaining high, the California housing market is showing robust sales gain and record-breaking price as we move into the sixth month of the summer homebuying season.

Even as mortgage rates dropped below 3% again, some purchasers were discouraged by the rapid rise in home prices. Encouragingly, the number of new listings being added to the MLS each day has finally started to exceed closed sales and C.A.R. is still forecasting at least 10% growth in home sales this year. If the economy improves, rates could keep rising slowly, but many experts expect borrowing costs to remain low by historical standards throughout 2021. Here’s what consumers feel at this time.

C.A.R.’s monthly Consumer Housing Sentiment Index for May 2021 found that only 19% of consumers believe that now is the good time to buy a home, and 81% think this is not a good time to buy. That’s +6 last month. As a result of continuously rising prices in all the major regions, the housing market sentiment also shows that only 27% of the consumers feel that it will be easier to find a home over the next twelve months. 73% said it won’t be easier.

72% of Californians in the survey think this is a good time to sell a house. That’s an increase of +6 over the April 2021 poll. More than half of the consumers (62%) who participated in the survey feel that home prices will rise in the 12 months. That’s a gain of +3 from the previous month. However, only half of the people feel positive about the economic recovery. Only 48% (+1 from last month) believe that economic conditions will improve in the state over the course of the next 12 months while 52% still have a negative outlook.

Realtor.com takes into account market demand and the pace of the market to determine an area’s hotness. That is determined by the number of unique viewers per property and the number of days a listing is active on Realtor.com’s website. In their latest hottest housing markets report for March 2021, California had six in the top 20, more than any other state.

These hottest markets saw median listing prices 18.9% higher, on average than the national price in March. The report shows that spillover and secondary markets continue to dominate the list as buyers prioritize space while remaining close to major hubs.

Vallejo-Fairfield metro area was no. 3, with the median listing price of $550,000. It had the lowest median number of days on the market, at 11. It has been on the company’s top 20 list for the last several years. Other Northern California cities in the top 20 include Yuba City in Sutter County, which came in seventh place with a median listing price of $427,000.

The Santa Cruz-Watsonville metro area was No. 8, with a median listing price of $1.2 million, and Stockton-Lodi metro area followed at No. 9 with a median listing price of $468,000. The Modesto area came in at No. 12, with a median listing price of $499,000. And in the far northwest corner of the state, the Eureka-Arcata-Fortuna area came in at No. 18, with a median listing price of $439,000.

At the regional level, all major regions saw sharp sales gains in May, with each region growing at least 44 percent from last year. The Central Coast had the highest year-over-year increase of 111.8 percent. Three out of five major regions reached new record high median prices in May, with each region growing more than 20 percent from a year ago. The San Francisco Bay Area had the highest year-over-year gain of 38.9 percent.

These monthly and yearly trends numbers can be positive or negative depending on which side of the fence you are — Buyer or Seller? Home sales rebounded in June 2020 for the first time since the pandemic and California’s median home price reached $626,170, improving 6.5 percent from May and 2.5 percent from June 2019.

The monthly price increase was higher than the historical average price change from May to June and, in fact, was the highest ever recorded for a May-to-June change. Factors are businesses reopening, mortgage payments are falling, and some sellers are more ready and eager to sell. Sales remain strong in a traditional off-season and this year looks promising across the region.

It looks like 2021 will end with a new record at home sales and prices. All 51 counties tracked by C.A.R. reported a gain in median price on a year-over-year basis, with 50 of them reporting at least a double-digit growth rate from last May. Nearly all counties — 49 of 51 — tracked by C.A.R. recorded a year-over-year sales increase in May. Whether you’re looking to buy or sell, timing your local market is an important part of real estate investment.

For sellers in the California housing market, it is a good time to sell. A low inventory would keep the prices from falling. Sales Price to List Price ratio has been 103.8% in May 2021. 70.7% of homes were sold above their initial asking prices on MLS. A seller would always prefer this ratio to be close to 100% or higher.

For buyers in the California housing market, it is a good time to buy. Low-interest rates continue to fuel optimism for homebuying. The 30-year, fixed-mortgage interest rate averaged 2.96 percent in May, down from 3.23 percent in May 2020, according to Freddie Mac. Interest rates remain low giving buyers the purchasing power and home prices a boost. Fortunately, new listings have finally started to rise, which could help to sustain a higher level of home sales deeper into summer by providing much-needed supply.

All of these factors have led the market to optimism in homebuyers. Recent forecasts from industry groups like Freddie Mac and the Mortgage Bankers Association have predicted that the average rate for a 30-year fixed mortgage could stay within the low 3% range well into 2021.

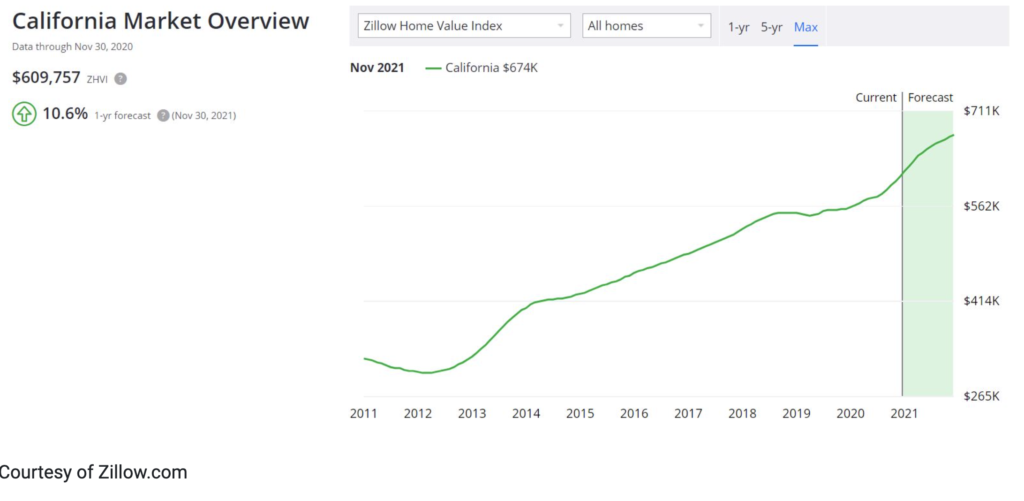

What are the California real estate market predictions for 2021 & 2022? California housing market is shaping up to continue the trend of the last few years as one of the hottest markets in the U.S. Let us look at the price trends recorded by Zillow over the past few years. Since 2012, the California home values have appreciated by nearly 114% — Zillow Home Value Index.

ZHVI is not the median price of homes that are sold in a month within a geographic region. It is calculated by taking all estimated home values for a given region and month (Also called Zestimates), taking a median of those values, applying some adjustments to account for seasonality or errors in individual home estimates. It, therefore, represents the whole housing stock and not just the homes that list or sell in a given month.

By this calculation, the current typical home value of homes in California is $654,629. It indicates that 50 percent of all housing stock in the area is worth more than $654,629 and 50 percent is worth less (adjusting for seasonal fluctuations and only includes the middle price tier of homes).

In May 2020, the typical value of homes in California was around $583,000. Home values have gone up 12.5% over the last twelve months. It can be said that California is currently the seller’s real estate market which means that demand is exceeding the supply, giving sellers an advantage over buyers in price negotiations.

There are fewer homes for sale than there are active buyers in the marketplace. Buyer demand remains robust, which has been pushing home prices up by a double-digit rate of appreciation. Although the latest price forecast is not available earlier Zillow had predicted a growth of 10.6% in ZHVI by November 2021.

CAR’s latest weekly housing data for the week ending May 29, 2021, shows that since the recovery began, housing has been at the forefront of economic growth, but multiple indicators suggest that hot market conditions are driving the market to cool sooner than expected. Closed sales are expected to climb by double digits in May and June, while overall home sales are declining from their decades-high levels at year’s end.

California REALTORS® are positive about the market as we move into the sixth month of the summer homebuying season. About 48% of them expect sales to improve in the upcoming week, while nearly 58.8% believe prices will increase from the prior week. With the passing of the American Rescue Plan Act, the economic outlook is more positive than it was a couple of months ago when California was still under a lockdown.

The economy is slowly recovering. There was strong growth in employment in May and a surge in consumer confidence to the highest level in the year. California ended May with its 9th consecutive week with fewer than 100,000 new claims for pandemic and traditional unemployment insurance. With less than 65,000 new unemployment claims filed, last week also marks the smallest number of claims since March of 2020. As the economy is poised to reopen in the coming weeks, many of the service sector jobs, which bore the majority of the job losses, are expected to to begin to recover.

Tight supply, however, remains a concern as it continues to hold back demand and continues to put pressure on affordability. Although the amount of new listings entering the MLS is still below normal levels, a rise in supply could aid would-be buyers in an extremely competitive market and help to maintain a high number of house sales.

On the flip side, the economic recovery will continue to put upward pressure on mortgage rates. Rates are still below last year’s level though and they should remain so in June. The margin between this year and last year, however, is narrowing and we could begin to see interest rates rising above last year’s level starting in June if inflation remains elevated in the coming weeks. The average 30-year fixed-rate mortgage (FRM) dipped slightly to 2.96% last week – remaining below the critical 3% threshold.

Last week, the number of fresh mortgage purchase applications dropped by 24% to the lowest level since January. New applications began to slow in April after climbing for 52 weeks in a row on a year-over-year basis. Mortgage applications began to decline in mid-May, and by the first week of June, they had dropped by double digits. This is in line with last week’s C.A.R. and Fannie Mae home purchase attitude indexes, which indicated rising buyer pessimism as prices climb and competition for limited available listings remains fierce.

Fewer California REALTORS® expect prices and listings to go up in the coming week. The results from the latest C.A.R. weekly survey suggest that nearly 58.8% expect prices to go up next week. They believe housing demand is still stronger than normal so far in 2021, and tight supply will continue to put upward pressure on housing values.

Survey results also suggest that supply will remain tight as 51.6% of those who responded to the survey believed listings will increase in the following week, which is 9,9% more than last week. Therefore, robust price growth will not ease up until some balance between supply and demand is restored. Low-interest rates, which are still low, could give buyers the purchasing power and home prices a boost.

California’s housing market forecast for 2021 is on the positive side but things could vary a bit, given the seriousness of the ongoing pandemic. Here’s a rundown of the latest market trends.

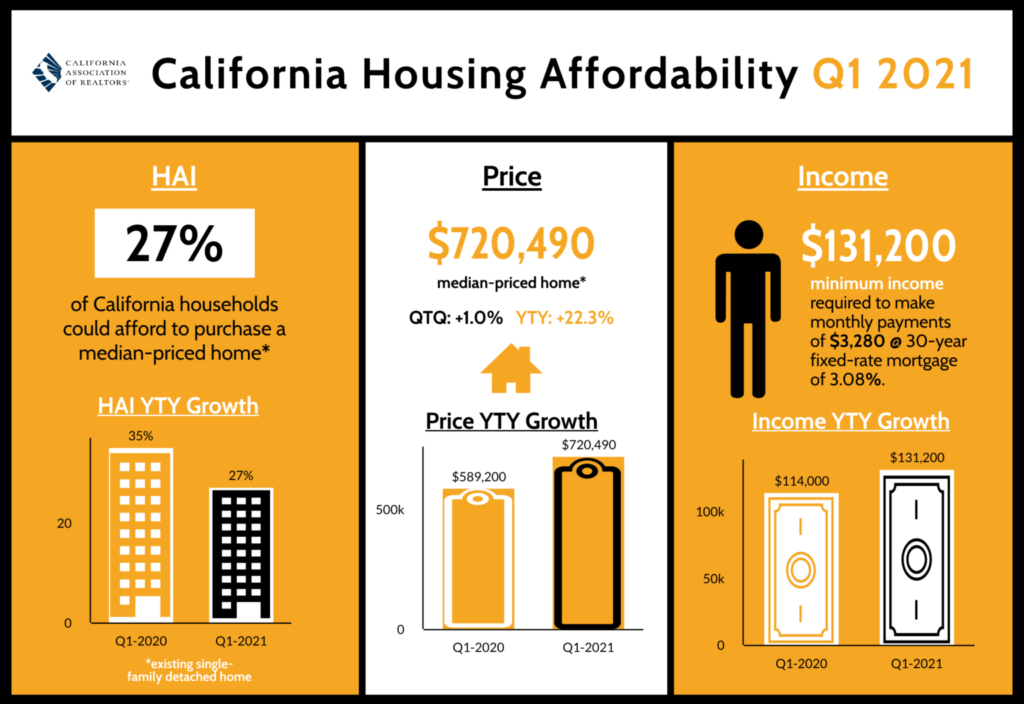

Source: Q1 2021 Housing Affordability Index By C.A.R.

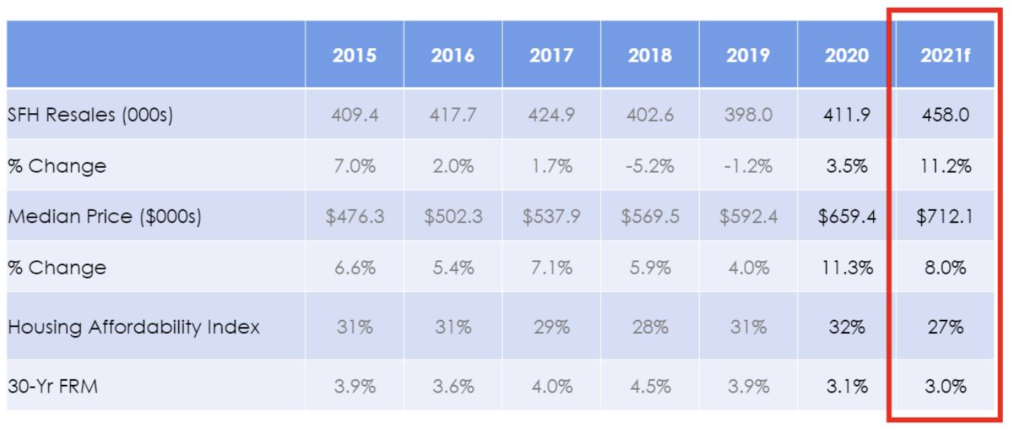

This year, the California Association of Realtors’ economic forecast looks at several scenarios in predicting whether home prices and sales will rise or fall in 2021. Low mortgage interest rates and pent-up demand will bolster California home sales in 2021.